Operating in Uzbekistan's financial market for 34 years, "Turonbank" JSCB currently provides quality services to legal entities and individuals through its 20 banking service centers and more than 60 branches across the country.

In 2024, the commercial bank conducted effective operations to meet the financial needs of citizens and introduced new products into practice. Members of the Management Board of "Turonbank" JSCB provided detailed information about this at a press conference held at the National Press Center.

As noted, as of November 1, 2024, the bank's total capital amounted to 1.917 trillion soums. During the same period, assets reached 17.002 trillion soums, reflecting a 6.7% increase. Furthermore, the volume of deposits attracted from legal entities and individuals since the beginning of 2024 amounted to 5.097 trillion soums, which is 9.4% higher compared to the same period last year. Total loan disbursements reached 12.405 trillion soums, showing a 4.3% growth compared to the beginning of the year.

During the press conference, special attention was given to the services provided by "Turonbank" to individuals. In particular, since the beginning of 2024, the bank allocated a total of 476.6 billion soums in loans to individuals. Of this, 130.0 billion soums was allocated to 543 customers for mortgage loans, 142.6 billion soums to 8,515 self-employed individuals as microloans, 66.5 billion soums to 2,780 individuals as microcredits, 70.3 billion soums to 510 customers for car loans, 21.5 billion soums to 2,141 students as education loans, and 44.2 billion soums to 5,658 customers as online microcredits.

Additionally, as of November 1, the balance of individual deposits at "Turonbank" amounted to 1.577 trillion soums, which represents a 26% increase compared to the same period last year. As a result, deposit options offering convenience and benefits to customers were introduced, including the "Premium," "Kelajak Poydevori," "Ustuvor," "Imkoniyat Plus," and "Maksimum Online" deposits in national currency, as well as the "Optimum" deposit in foreign currency.

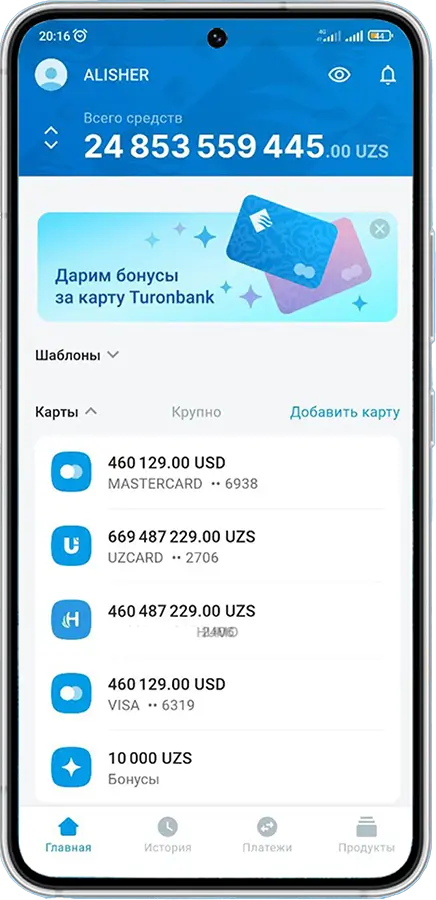

Moreover, to expand cashless transactions and increase the issuance of plastic cards, 627,871 national currency plastic cards were issued in 2024, including 394,544 "UzCard" cards and 223,327 "Humo" cards. In addition, the bank issued 2,192 "Visa" and 731 "MasterCard" international plastic cards to customers. Throughout the Republic, there are currently 143 ATMs for "UzCard," 133 for "Humo," and 62 currency exchange ATMs available for cash withdrawals, deposits, and other operations.

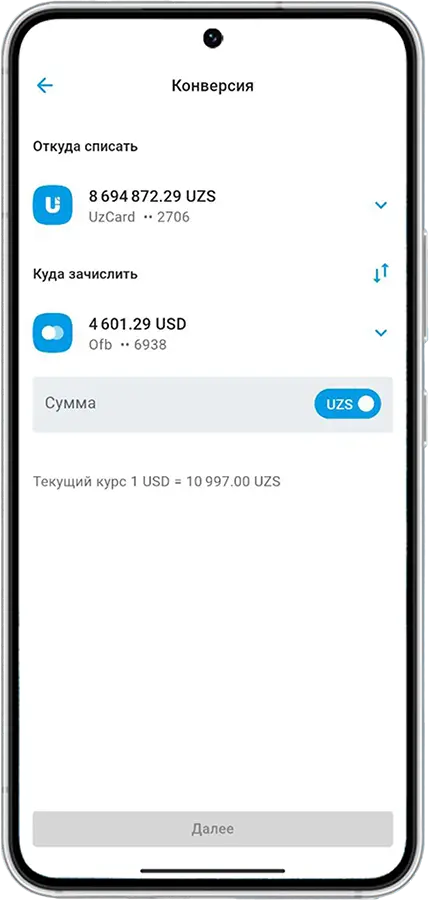

It is also worth mentioning that in collaboration with the International Finance Corporation, "Turonbank" developed an updated version of its new "MyTuron" mobile application in 2022. Featuring a new design, modern interface, and a wide range of banking services, the app has been downloaded and successfully registered by over 400,000 users as of November 1, 2024. The "MyTuron" mobile application offers various functionalities, including obtaining online microloans in a few minutes, ordering "UzCard," "Humo," "Visa," and "MasterCard" plastic cards, opening "Humo Virtual" cards for free, and making various payments.

In addition, "Turonbank" provides convenient mortgage loans to meet the housing needs of the population. Customers looking to purchase housing in the primary or secondary markets can apply for mortgage loans with terms ranging from 10 to 20 years, starting at an annual rate of 17.5%, without formal income proof, and up to 420 million soums. Naturally, terms may vary depending on the chosen property and its initial payment.

For instance, one of the most popular mortgage loans currently allows registration with an initial payment of 15%, an annual rate of 17.5%, and a term of up to 20 years. Loan limits are up to 330 million soums in the Republic of Karakalpakstan and regions, and up to 420 million soums in Tashkent City.