About the deposit

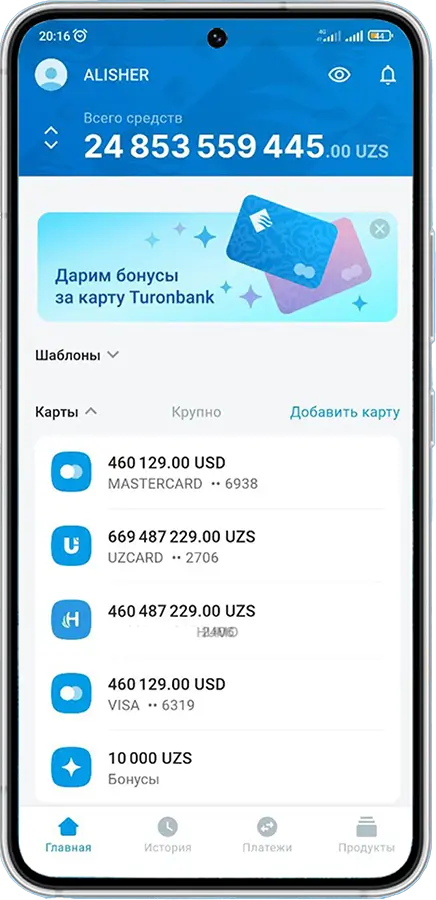

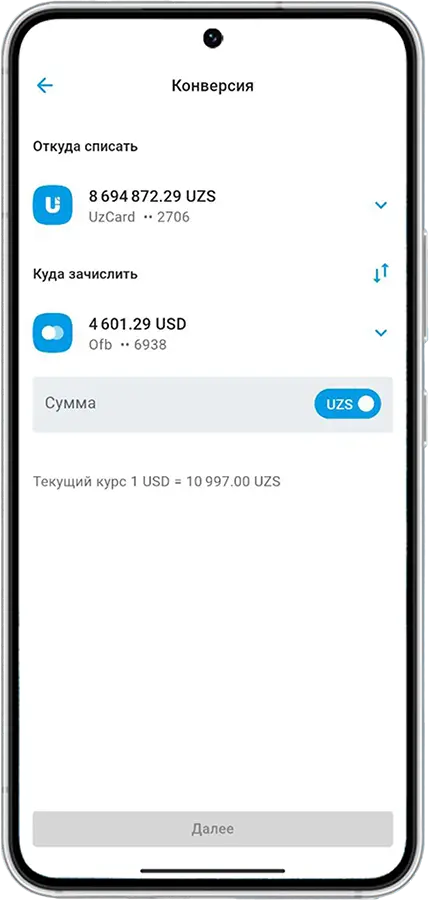

Funds for the deposit are accepted in both cash and non-cash forms, as well as in an online deposit in a non-cash form from individuals' plastic cards.

The minimum initial deposit amount is not limited.

Partial withdrawals from the principal deposit amount are not allowed, except for accrued interest. Additional deposits are accepted in amounts of at least 500 000 UZS.

Interest on the deposit is accrued starting from the day following the date of its receipt by the bank until the day preceding its return to the depositor.

Interest on the deposit is paid to the depositor monthly or at the end of the deposit term.

In case of early termination of the deposit after 1-3 full months, interest is accrued and paid at an annual rate of 16%. If the deposit is closed early after 4-7 full months, the annual interest rate is 17%, after 8-11 full months – 18%, and after more than 12 months – 19%.

Accrued interest is not capitalized.

Terms of the Deposit

For 3 months – 16%

For 7 months – 17%

For 11 months – 18%

Over 12 months – 19%

Format: xlsx

Documents

Format: doc

JSC “Turonbank” guarantees the timely repayment of deposit funds. The safety of deposits is ensured in accordance with the Law of the Republic of Uzbekistan “On Guarantees of Protection of Bank Deposits”. Your deposits are guaranteed!

Under this Law, the guaranteed amount of deposits for each depositor is set at 200 million UZS.