About loan

|

EcoGreenCar |

|

|

Loan amount |

Interest rate |

Term of loan |

Initial payment |

Method of repayment |

|

For the primary market – up to 2000-fold size of BCV For the secondary market – up to 1500-fold the size of BCV |

28% |

Up to 48 months |

From 36% |

Annuity |

|

EcoGreenCar |

|

|

Loan amount |

Interest rate |

Term of loan |

Initial payment |

Method of repayment |

|

For the primary market – up to 2000-fold size of BCV For the secondary market – up to 1500-fold the size of BCV |

28% |

Up to 48 months |

From 25% |

Annuity |

The order of execution of the loan

|

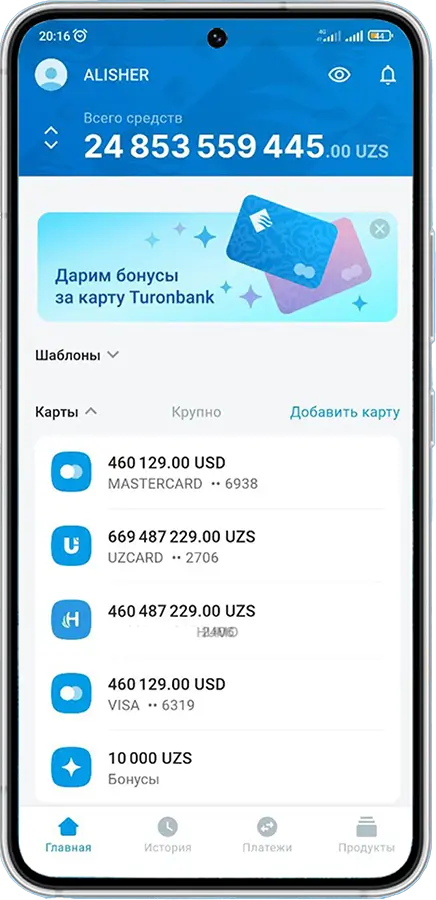

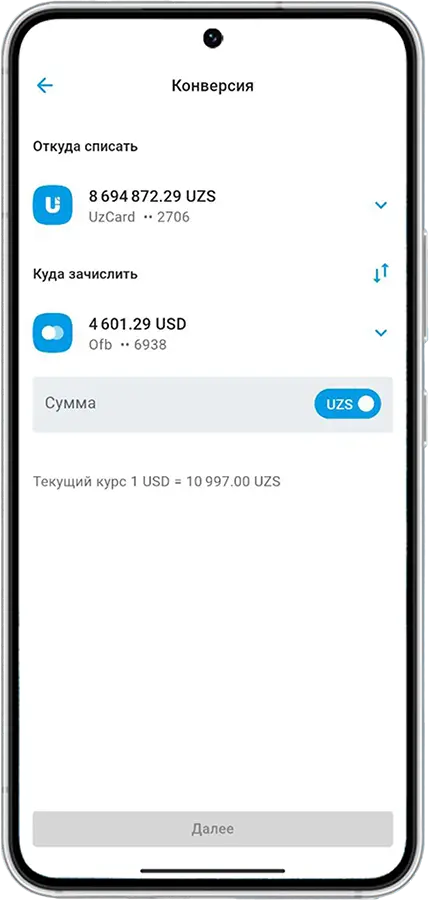

1 Application Leave an online application in the MyTuron app in 3 minutes Leave an application |

2 Visit the Bank's office After approval of the Decision to grant credit, you can leave the documents at the bank office Our addresses |

3 The loan is ready The loan is executed and the funds will be transferred under the contract Loan calculation |

Download the MyTuron mobile application via PlayMarket and Appstore

Loan terms

Format: xlsx

Documents

Format: docx

Format: pdf

You can apply for a loan at a Bank branch or on the website. Online applications are accepted around the clock and are processed quickly.

Fill in the online application form. Our employee will contact you and tell you about the conditions of registration and issue.