About loan

|

It is allocated to self-employed individuals paying social tax to start their own businesses |

|

| Loan amount | Interest rate |

Loan term |

Initial payment | Method of repayment | Grace period |

|

Up to UZS 50 000 000 |

25% |

up to 48 month |

no |

annuity |

no |

Special conditions:

Highlighted for specific purposes:

- These loan funds are allocated based on the recommendation of the mahalla banker;

- The targeted use of these loan funds is carried out by mahalla bankers in the Central Bank;

- Citizens permanently registered in the mahallas assigned to the bank;

- When allocating a loan for livestock farming, the livestock must be identified by the district or city veterinary department;

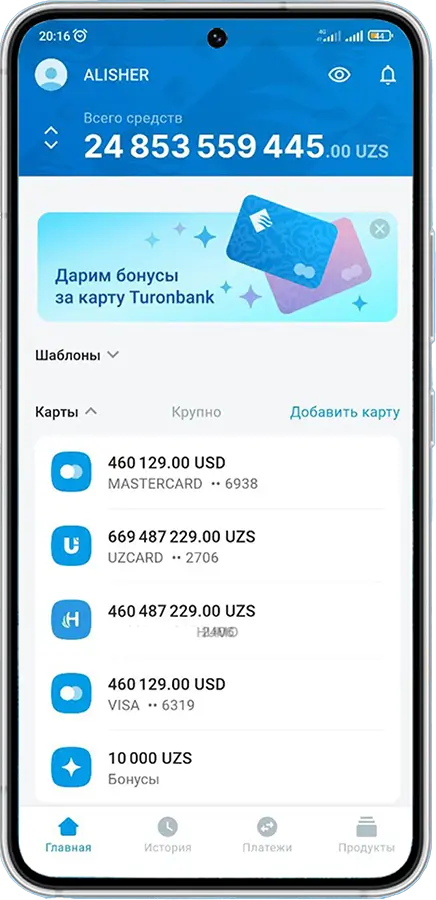

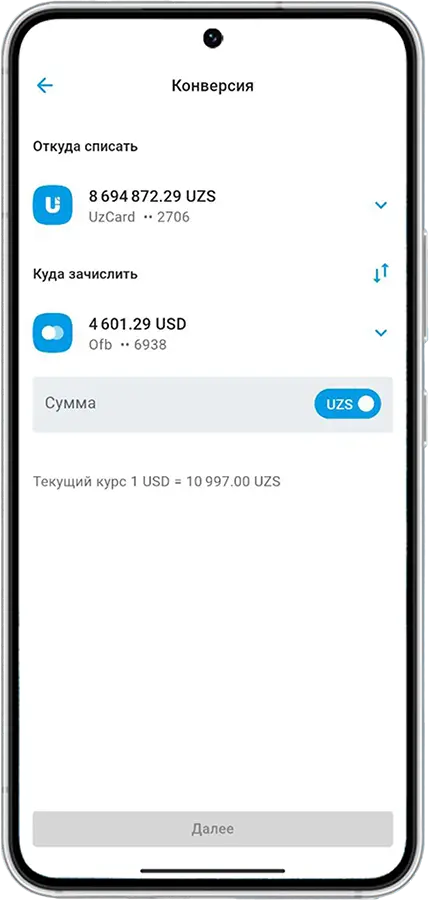

- The loan funds are transferred to the bank's plastic card opened at Turonbank JSCB, either in cash or by contract transfer.

Loan terms

Format: xlsx

You can apply for a loan at a Bank branch or on the website. Online applications are accepted around the clock and are processed quickly.

Fill in the online application form. Our employee will contact you and tell you about the conditions of registration and issue.