About loan

|

Mortgage loan for the purchase of housing in the primary market at the expense of the mortgage refinancing company |

|

| Loan amount |

|

| Interest rate |

20% |

| Loan term |

20 years |

| Down payment |

26% |

| Repayment method |

Annuity or differential (at the client's request) |

PROCEDURE FOR ISSUING A MORTGAGE LOAN

The procedure for allocating mortgage loans to the population for the purchase of housing on the primary market at the expense of the Uzbek Mortgage Refinancing Company is carried out in the following stages:

Stage 1. A citizen, based on their ability to pay, chooses housing for sale in the primary market based on their choice and concludes a contract with a contracting organization.

Stage 2. The citizen submits the necessary documents to the branches of the commercial bank along with the application for a mortgage loan for the purchase of the chosen apartment.

Stage 3. After reviewing the application, the bank issues a mortgage loan to the potential borrower.

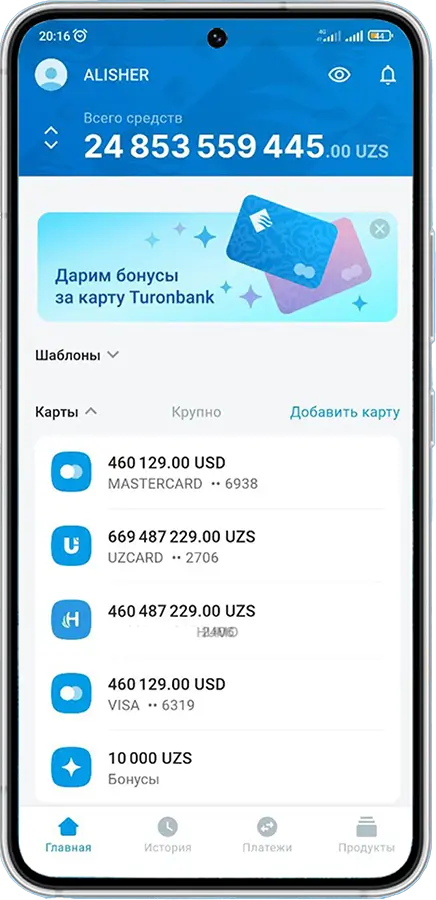

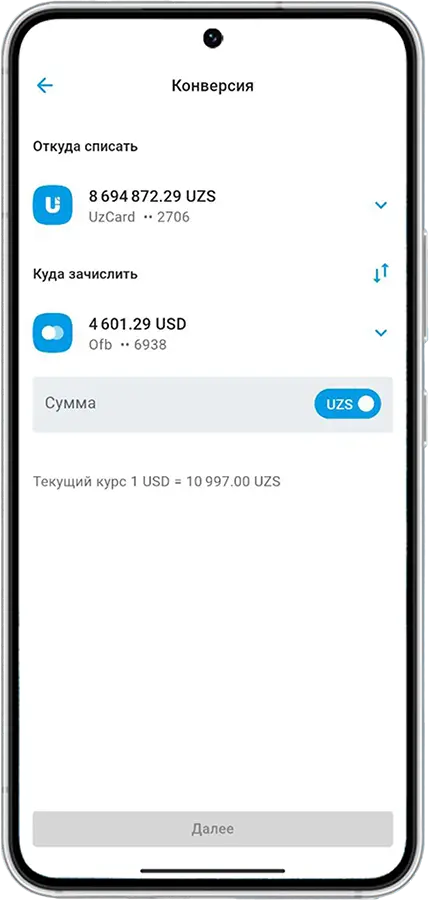

Download the MyTuron mobile app in PlayMarket and Appstore

Video

Loan terms

Format: xlsx

You can apply for a loan at a Bank branch or on the website. Online applications are accepted around the clock and are processed quickly.

Fill in the online application form. Our employee will contact you and tell you about the conditions of registration and issue.