About loan

|

"MG Avto" Car Loan |

|

||||||

| Amount of credit | up to 800 times the BCV | ||||||

| Term of credit | up to 60 months | ||||||

|

Interest rate |

Under the contract “MG-1” (purchase amount up to 250,000,000 UZS) with a 25% prepayment | ||||||

| 12 month |

24 month |

36 month |

48 month |

60 month |

|||

| 7% | 14,3% | 18,1% | 20% | 21,1% | |||

| Under the contract “MG-1” (purchase amount up to 250,000,000 UZS) with a 30% prepayment: | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

| 2% | 13,3% | 17,4% | 19,5% | 20,7% | |||

| Under the contract “MG-1” (purchase amount up to 250,000,000 UZS) with a 40% prepayment | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

| 0% | 11% | 15,7% | 18,1% | 19,6% | |||

| Under the contract “MG-1” (purchase amount up to 250,000,000 UZS) with a 50% prepayment | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

|

0% |

7,5% | 13,3% | 16,3% |

18% |

|||

| Under the contract “MG-2” (purchase amount from 250,000,000 to 350,000,000 UZS) with a 25% prepayment | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

| 13,1% | 19,5% | 21,7% | 22,9% | 23,5% | |||

| Under the contract “MG-2” (purchase amount from 250,000,000 to 350,000,000 UZS) with a 30% prepayment | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

| 12,0% | 19,0% | 21,3% | 22,6% | 23,3% | |||

| Under the contract “MG-2” (purchase amount from 250,000,000 to 350,000,000 UZS) with a 40% prepayment | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

| 9,5% | 17,6% | 20,4% | 21,8% | 22,6% | |||

| Under the contract “MG-2” (purchase amount from 250,000,000 to 350,000,000 UZS) with a 50% prepayment | |||||||

| 12 month | 24 month | 36 month | 48 month | 60 month | |||

| 6% | 15,6% | 19% | 20,7% | 21,7% | |||

| Under the contract “MG-3” with 25% annual interest and a 25% prepayment | |||||||

| Initial payment | For citizens with official monthly income - 25% | ||||||

| For citizens who do not have an official source of income - from 30% | |||||||

The order of execution of the loan

|

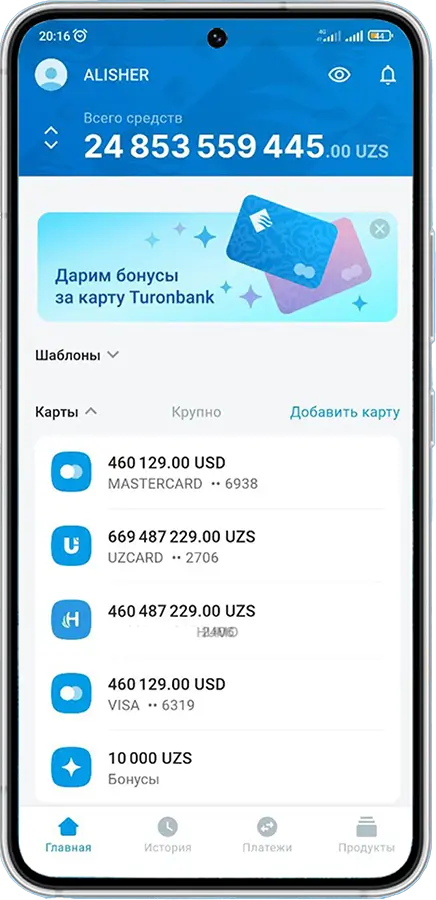

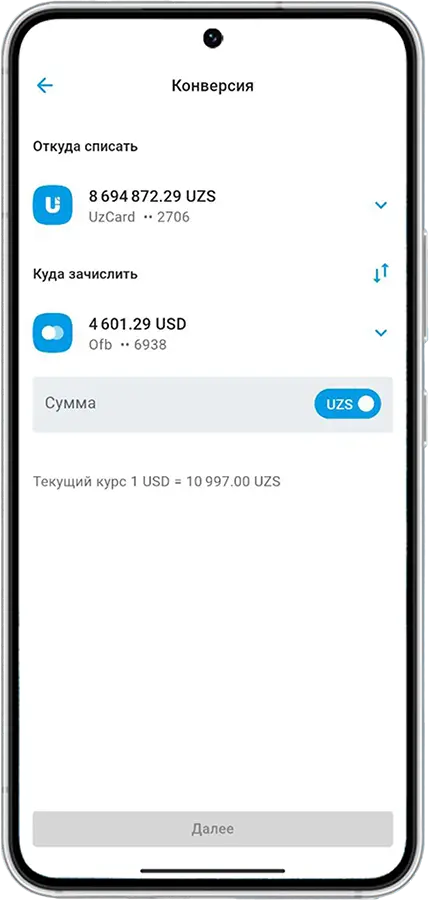

1 Application Leave an online application in the MyTuron app in 3 minutes Leave an application |

2 Visit the Bank's office After approval of the Decision to grant credit, you can leave the documents at the bank office Our addresses |

3 The loan is ready The loan is executed and the funds will be transferred under the contract Loan calculation |

Download the MyTuron mobile application via PlayMarket and Appstore

Loan terms

Format: xlsx

Documents

Format: docx

Format: pdf

You can apply for a loan at a Bank branch or on the website. Online applications are accepted around the clock and are processed quickly.

Fill in the online application form. Our employee will contact you and tell you about the conditions of registration and issue.